LEADBROKER IO

Purpose Built Marketing Solution with One End Goal in Mind - Revenue Generation!

While your competitors are still manually qualifying leads and sending generic follow-ups, your automated marketing machine is capturing prospects, nurturing relationships, and booking appointments 24x7. The N2Open Digital marketing automation system transforms lenders from reactive order-takers into proactive market leaders who close more deals with less effort. In 90 days, you'll wonder how you ever competed without a system that works harder than your best loan officer.

N2Open Digital was built for Commercial Lenders

How It Works

Step 1

Drive Traffic with Paid Ads

Transform your marketing from expense into your most profitable investment. Our AI-powered lead generation systems identify and attract borrowers who are actively seeking funding. Stop wasting budget on unqualified leads and start filling your pipeline with prospects who are ready to borrow.

Step 2

Qualify Leads with AI

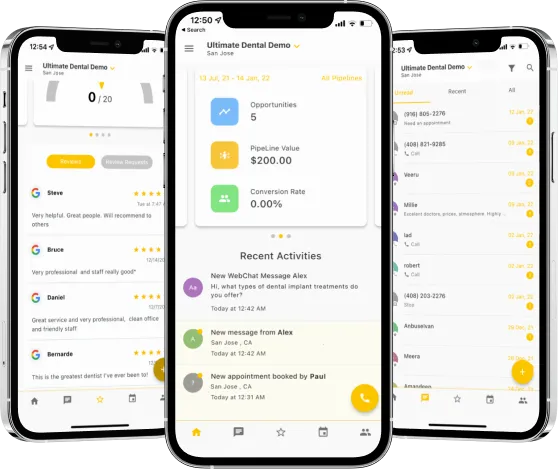

Never let another qualified prospect slip through the cracks because of slow response times. Our intelligent lead management system automatically qualifies, nurtures, and books appointments with hot prospects while you sleep. Turn your CRM from a digital filing cabinet into a revenue-generating machine that works 24/7.

Step 3

Book Sales Calls in Your Calendar

Eliminate the chaos of manual loan processing that kills deals and burns out your team. Our automated loan processing system guides borrowers through every step while keeping your team informed and compliant. Transform weeks of back-and-forth into a smooth, professional experience that closes more loans faster.

LEAD GENERATION

Drive Traffic to Your Loan Products

LEADBROKER IO - Multiply Your Marketing ROI Transform your paid ad spend from lead generation expense into scheduled appointment investment with our proprietary LeadBroker IO system

Paid Ads - Targeted Meta and Google Ad Campaigns, with AI-optimized ad copy that speaks directly to borrowers actively searching for funding

Organic Social - Create content and schedule for posting on all major social platforms

Email Marketing - Segmented campaigns based on loan type and market updates that keep you top of mind

Referral Campaigns - Automated referral requests sent to qualified colleagues and business professionals

Client Reactivation - Automated outreach sequences that re-engage dormant clients and create urgency with relevant offers

LEAD NURTURE

Convert More Prospects

AI Generated Lead Engagement

Conversational AI response system that acknowledges leads within 60 seconds, pre-qualifies prospects and books them into your calendar

Automated Nurture Sequences

Educational content, social proof campaigns and objection handling sequences that build trust and demonstrate urgency

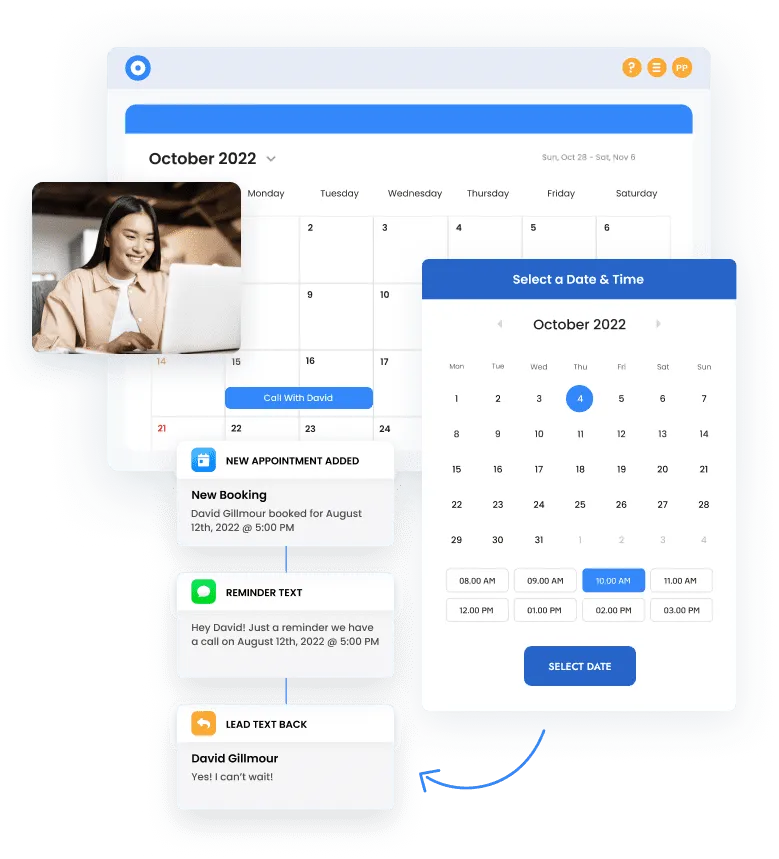

Scheduling Calendar

Automated and AI generated scheduling that books qualified prospects for loan consultations. Automated reminders that reduce no-shows and rescheduling workflows that capture prospects who miss their first appointment

Email/SMS Reminders

Personalized, multi-channel communication sequences, based on loan type, document requirements and meeting schedules

DIGITAL PRESENCE

Turn Your Website Into A Selling Machine

Smart Websites

Launch a mobile-optimized lending website, with AI chatbot integration, in hours instead of weeks using our intuitive drag-and-drop builder, and variety of templates, allowing you to project a professional presence without costly development delays

Funnel Builder

Create high-converting landing pages for specific loan products and marketing campaigns. Build complete application funnels that guide borrowers step-by-step through your qualification process, reducing abandonment and increasing completed submissions

Forms, Surveys & Quizzes

Implement intelligent application forms, surveys and quizzes that adapt based on borrower responses, provide education on loan products and qualify prospects based on pre-defined criteria

AI Powered Webchat Widget

Integrate our AI webchat widget that pre-qualifies website visitors 24x7, answering common lending questions and collecting application information even when your team is unavailable

INTELLIGENT DOCUMENT PROCESSING

Document Management as a Competitive Advantage

Online Digital Applications

Streamlined online applications that are mobile-optimized and can be completed in minutes

Documents & Contracts

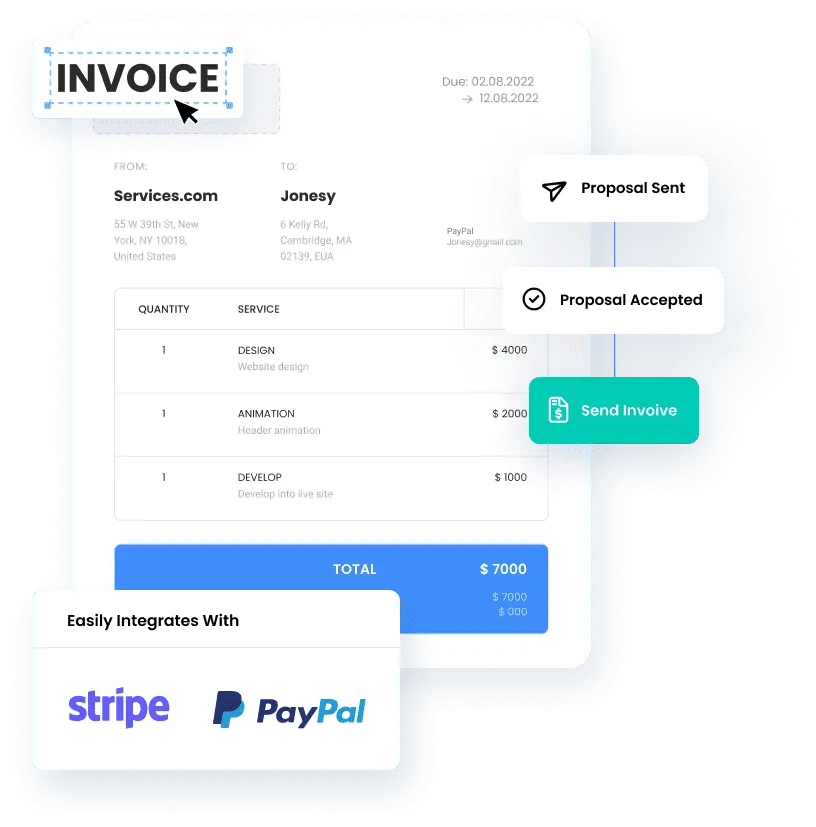

Automated contract generation based on approved loan terms. Template library for different loan types and customization options that let you tailor contracts to specific deals

E-Signature

Automated, legally binding, electronic signature workflows that guide borrowers through document execution. Mobile-friendly signing experience that works on all devices. Audit trails that provide legal protection and regulatory compliance

Secure Document Uploads

Secure document portal that accepts all file types and sizes. Integration with popular cloud storage services for seamless document flow

Automated Invoicing

Professional invoices that reinforce your brand and build vendor/lender confidence. Automated late payment reminders that maintain cash flow without awkward calls

PROCESS AUTOMATION

Streamline Every Deal From Initial Lead to Closed Funding

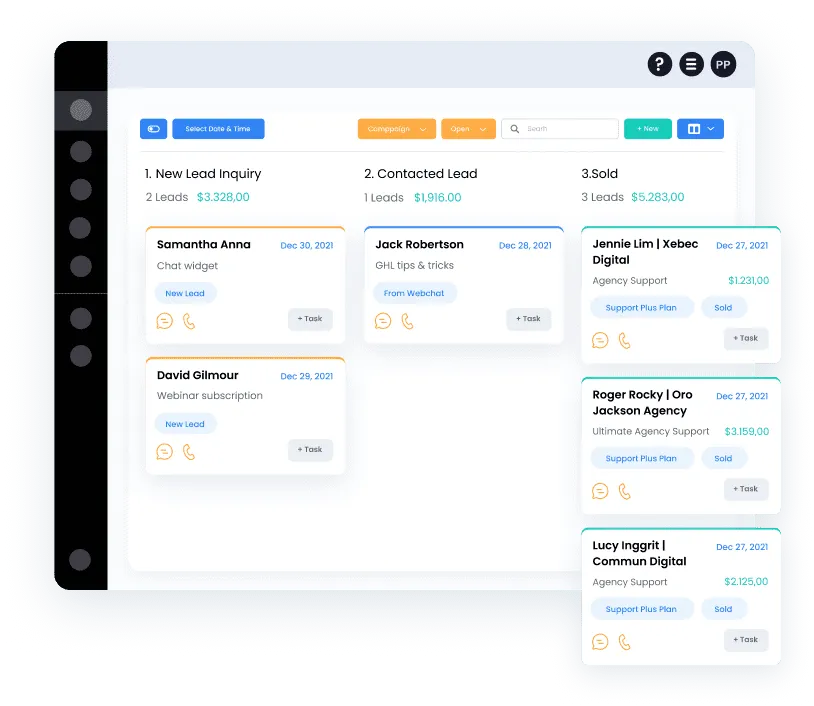

Pipeline

Visual pipeline that shows exactly where every deal stands in your process. Automated stage progression based on completed tasks and milestones. Custom fields and Tags that track the specific data points important to your business

Communication with Borrower at Each Step

Automated status updates that keep borrowers informed throughout the loan process. Proactive issue resolution that addresses problems and educational content that helps borrowers understand and complete required steps

Dashboard and Analytics

Real-time reporting that shows your most important lending KPIs. Conversion tracking that identifies where prospects drop out of your funnel. ROI analysis that proves which marketing channels generate the most profitable loans

CLOSE MORE DEALS

Turn Every Loan Into Multiple Future Opportunities

Request for Reviews

Automated review requests sent at the optimal moment after funding. Review response templates that handle both positive and negative feedback professionally

Reputation Management

Monitoring tools that alert you immediately when new reviews are posted. Response automation that acknowledges positive reviews and addresses concerns quickly

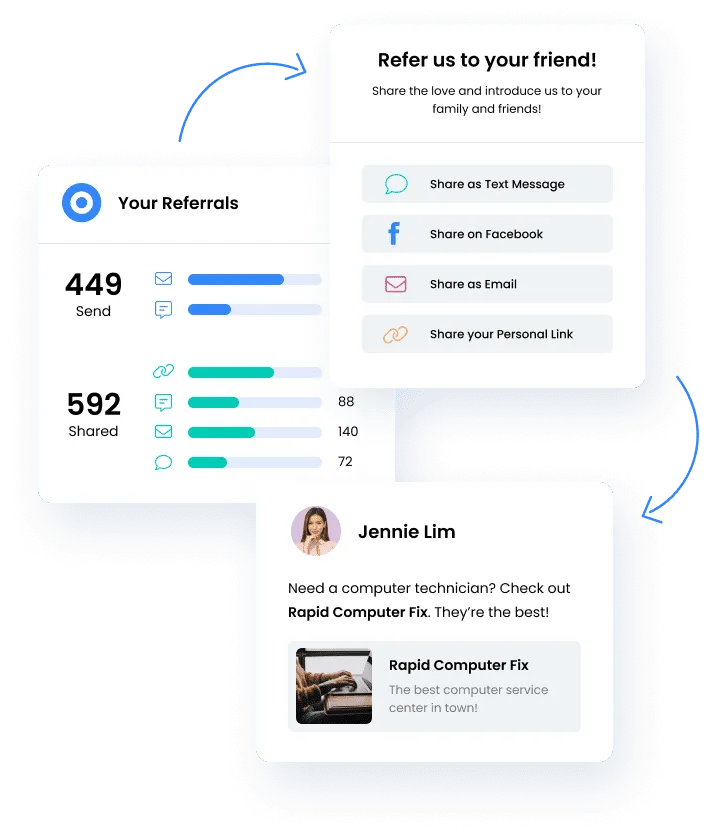

Request for Referrals

Smart timing algorithms that request referrals when borrowers are most satisfied. Easy sharing tools that make it simple for borrowers to refer friends and colleagues. Follow-up automation that nurtures potential referrals until they're ready to apply

See what our clients have to say

N2Open Digital has doubled my sales!

N2Open Digital has doubled my sales!

N2Open Digital has doubled my sales!

N2Open Digital has doubled my sales!

Share Your Value

Build Your Online Presence

Attract More Clients

Learn How Our All In One Marketing Automation System Can Transform Your Business

Solutions

Streamline Sales

Generate More Leads

Build Your Brand

Impress Existing Customers

AutomButtonate Tasks

Company