Digital Transformation

Build Your Business on Bulletproof Technology

Most lenders are cobbling together outdated systems with digital band-aids, wondering why they can't compete with tech-savvy competitors who close deals in hours instead of weeks. Our digital transformation isn't about flashy new software—it's about rebuilding your entire operation on a foundation that scales, adapts, and dominates your market for decades. We don't just implement technology; we architect your competitive advantage from the ground up, ensuring every dollar spent on tech multiplies your revenue instead of just maintaining the status quo.

Complete AI Transformation Management

How It Works

Step 1

Strategy

AI Audit - We diagnose your current systems and business processes to find inefficiencies, then design a bulletproof roadmap that will transform your lending operation. Our AI audit reveals processes that could be automated for maximum ROI, while our strategic consulting ensures every technology decision moves you closer to market dominance.

Step 2

Education

AI Training - Your team will master AI tools instead of fearing them, turning your staff into productivity superstars who embrace technology as their competitive edge. Our comprehensive training programs ensure your investment in AI actually gets used, adopted, and optimized by everyone from loan officers to underwriters.

Step 3

Integration

Project Management - We design, build, deploy, and optimize your entire technology stack with military precision, ensuring every integration works flawlessly from day one. Our project management methodology keeps implementations on time and on budget while our custom automations create solutions that fit your unique lending workflows like a glove.

STRATEGIC CONSULTING

Future-Proof Your Business Against The Competition

Technology Trends - Stay ahead of industry shifts with intelligence on emerging tools and platforms reshaping the lending industry

Technology Stack - Design an integrated system architecture, where every tool works together and builds on each other seamlessly

Project Management - Integration of technology systems, processes and automations work seamlessly with existing tools and third-party providers

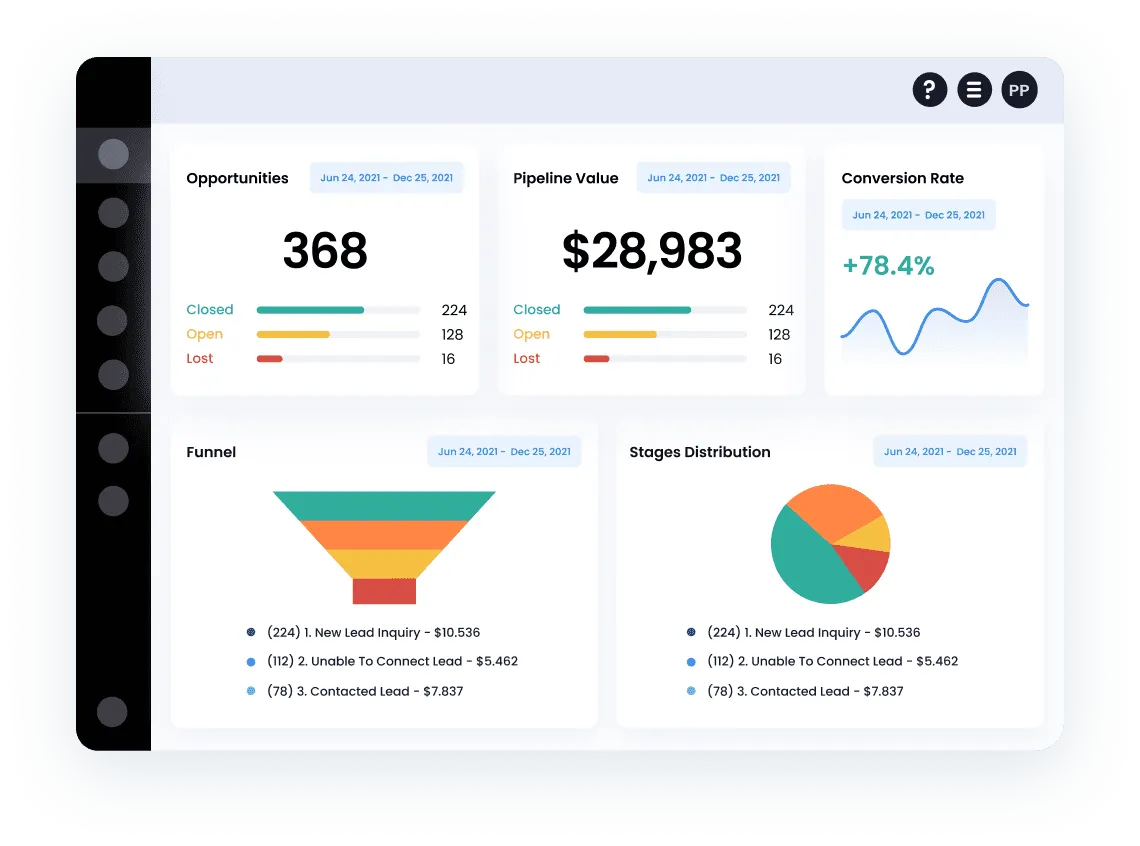

ROI Modeling - Calculate returns on technology investments so you know understand breakeven points and benefit to the bottom line

Risk Mitigation - Protect your business from technology failures, information security vulnerabilities, and regulatory changes

AI AUDIT

Uncover Hidden Opportunities

Process Analysis - Comprehensive business review that identifies manual tasks, bottlenecks, and inefficiencies costing you deals and profits

Strategic Planning - Develop a phased roadmap that prioritizes opportunities by impact and complexity so you tackle the highest-ROI improvements first

Revenue Enhancement - Discover untapped opportunities to increase loan volume, and capture more profitable borrowers

Cost Reduction - Pinpoint where automation can reduce costs, mitigate errors, and streamline expensive manual processes

Time Savings - Calculate how many hours per deal you're wasting on tasks that AI could handle in minutes

TECHNOLOGY INTEGRATION

Professional AI Implementation

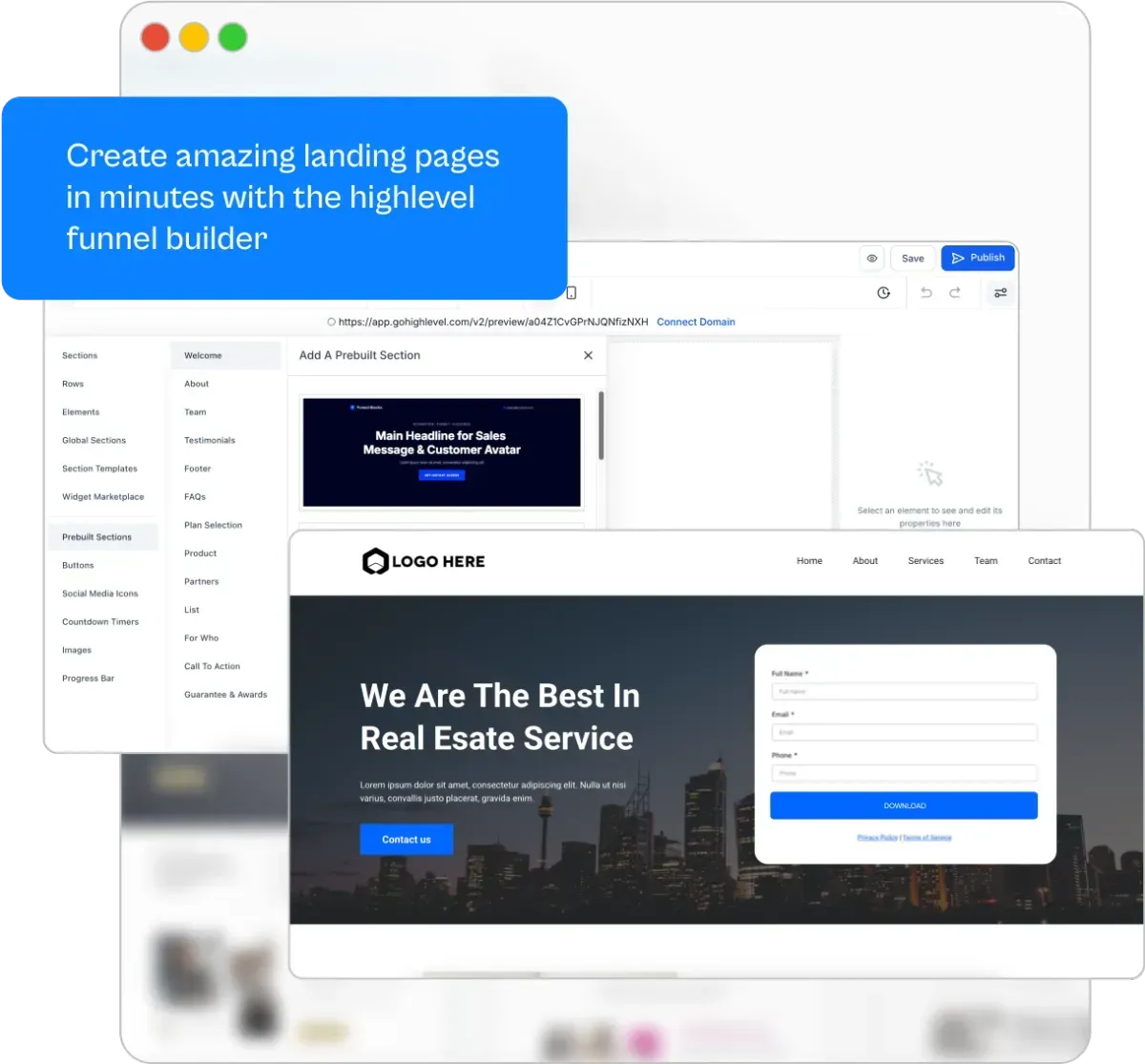

Design. Build. Deploy. - Architect AI automation solutions tailored to your business' unique lending workflows

Professional Development - Configure and integrate all systems using enterprise-grade security and performance standards

Automated Workflow - Build streamlined processes that handle routine tasks, while escalating complex decisions to humans

Seamless Integration - Connect new AI tools with existing CRM, LOS, and third-party services without data loss or operational downtime

Testing and Optimization - Comprehensive quality assurance that ensures everything works perfectly

TRAINING & EDUCATION

Transform Your Team into AI Champions

Executive Webinars - Leadership-focused sessions on AI strategy, ROI, and change management for successful adoption

Hands-On Team Training - Practical workshops where your staff learns to use AI tools on real loan scenarios

Theory and Application - Comprehensive education covering both the "why" behind AI and the "how" of daily implementation

Ongoing Education - Regular updates and advanced training as AI tools evolve and your team becomes more sophisticated

PROJECT MANAGEMENT

Professional Project Execution

Project Initiation - Clear scope definition, timeline development, and stakeholder alignment

Project Milestones - Phased implementation that delivers progess reports monthly

Risk Management - Proactive identification and mitigation of potential issues

Stakeholder Communication - Regular updates, progress reports, and decision points that keep leadership informed

Budget Control - Transparent cost tracking and change management that prevents scope creep and surprise expenses

Quality Assurance - Rigorous testing protocols that ensure every deliverable meets performance standards before sign-off

Final Documentation and Handoff - Complete system documentation, training materials, and transition planning for long-term success

See what our clients have to say

N2Open Digital has doubled my sales!

N2Open Digital has doubled my sales!

N2Open Digital has doubled my sales!

N2Open Digital has doubled my sales!

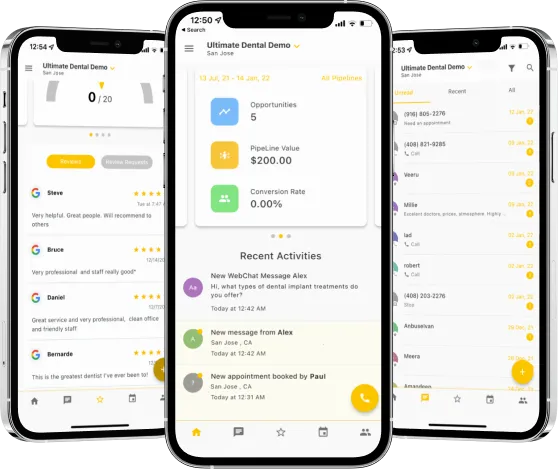

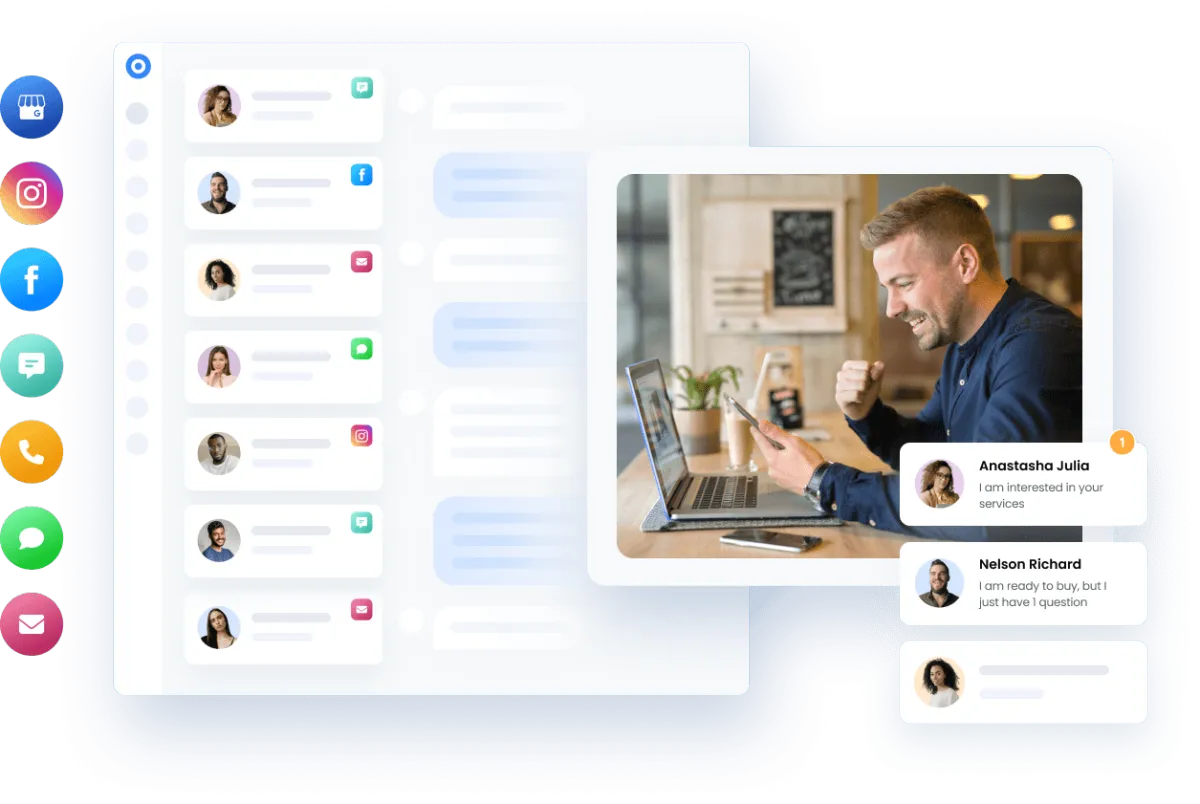

Capture More Leads

Text-Based Chat

Automate Responses

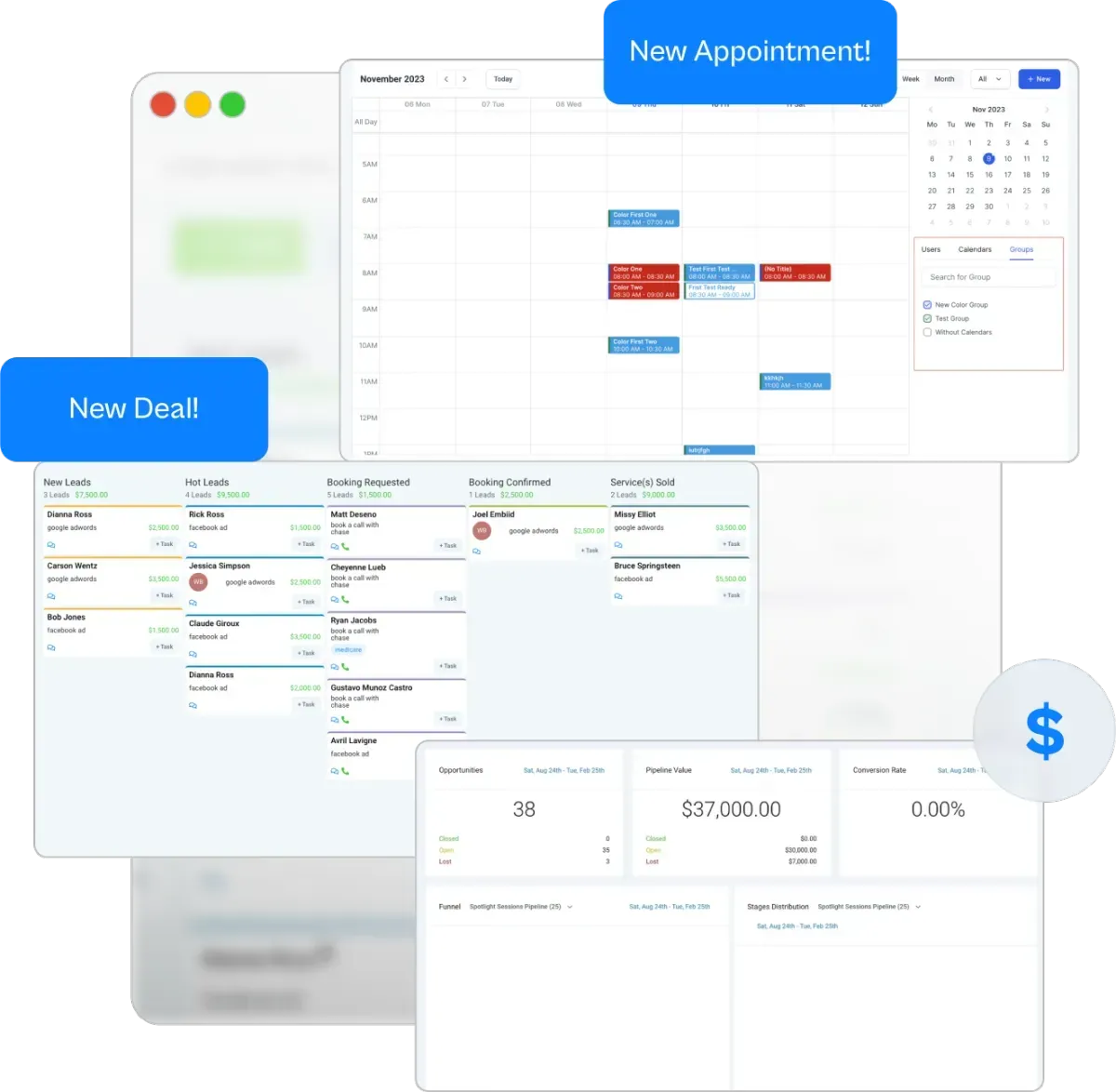

Turn Your Lending Operation Into a Precision Machine

Solutions

Streamline Sales

Generate More Leads

Build Your Brand

Impress Existing Customers

AutomButtonate Tasks

Company