Marketing Automation

Stop Losing Deals to Faster Competitors -Automate Your Way to Market Dominance

While your competitors are still manually qualifying leads and sending generic follow-ups, your automated marketing machine is capturing prospects, nurturing relationships, and booking appointments 24x7. The N2Open Digital marketing automation system transforms lenders from reactive order-takers into proactive market leaders who close more deals with less effort. In 90 days, you'll wonder how you ever competed without a system that works harder than your best loan officer.

N2Open Digital was built for Commercial Lenders

How It Works

Step 1

Drive Traffic / Generate Leads

Transform your marketing, from an expense, into your most profitable investment. Our AI-powered lead generation systems identify and attract borrowers who are actively seeking funding. Stop wasting your budget on unqualified leads and tire kickers, and start filling your pipeline with qualified prospects who are ready to borrow.

Step 2

Nurture and Qualify Leads

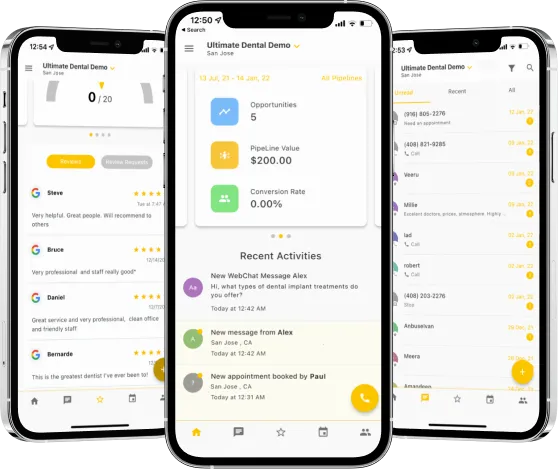

Never let another qualified prospect slip through the cracks because of slow response times. Our intelligent lead management system automatically qualifies, nurtures, and books appointments with hot prospects while you sleep. Turn your CRM into a revenue-generating machine that works 24x7.

Step 3

Process Loans / Close More Deals

Eliminate the chaos of manual loan processing that wastes time, kills deals and burns out your team. Our automated loan processing system guides loan originators and their borrowers through every step while keeping the prospect and your team up-to-date and aware. Transform weeks of back-and-forth into a smooth, professional experience that closes more loans faster.

LEAD GENERATION

Drive Traffic to Your Loan Products

LEADBROKER IO - Multiply Your Marketing ROI Transform your paid ad spend from lead generation expense into scheduled appointment investment with our proprietary LeadBroker IO system

Paid Ads - Targeted Meta and Google Ad Campaigns, with AI-optimized ad copy that speaks directly to borrowers actively searching for funding

Organic Social - Create content and schedule with our Social Media Planner that will automate the delivery on all major social platforms

Email/SMS Marketing - Create segmented e-mail/SMS campaigns based on loan type and market updates that keep you top of mind

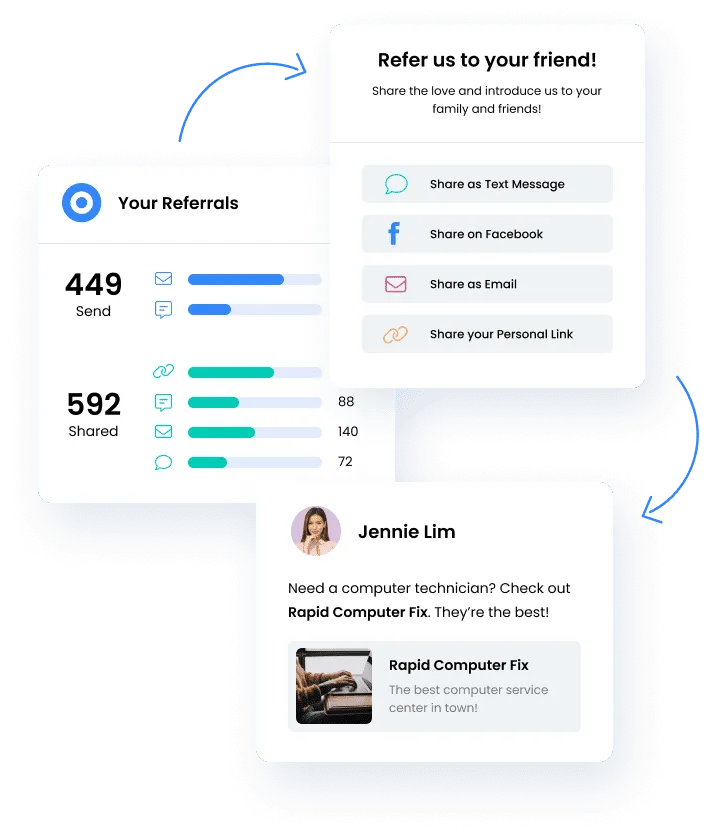

Referral Campaigns - Automated referral requests sent to qualified colleagues and business professionals to bring in new opportunities

Client Reactivation - Automated outreach sequences that re-engage dormant clients and create urgency around relevant offers

LEAD NURTURE

Convert More Prospects

AI Generated Lead Engagement - On average most companies take 29 hours to respond to a lead, A Harvard study found that your chances of converting a lead decline by 400% after the first 5 minutes. Our AI powered ChatBot reaches out and qualifies leads in under 60 seconds (24x7)

Automated Nurture Sequences - 95% of converted leads are reached on or after the 6th call attempt, yet only 10% of salespeople make more than 3 attempts. Our lead nurture sequences automate the process of sending educational content, social proof and objection handling content that build trust and demonstrate urgency

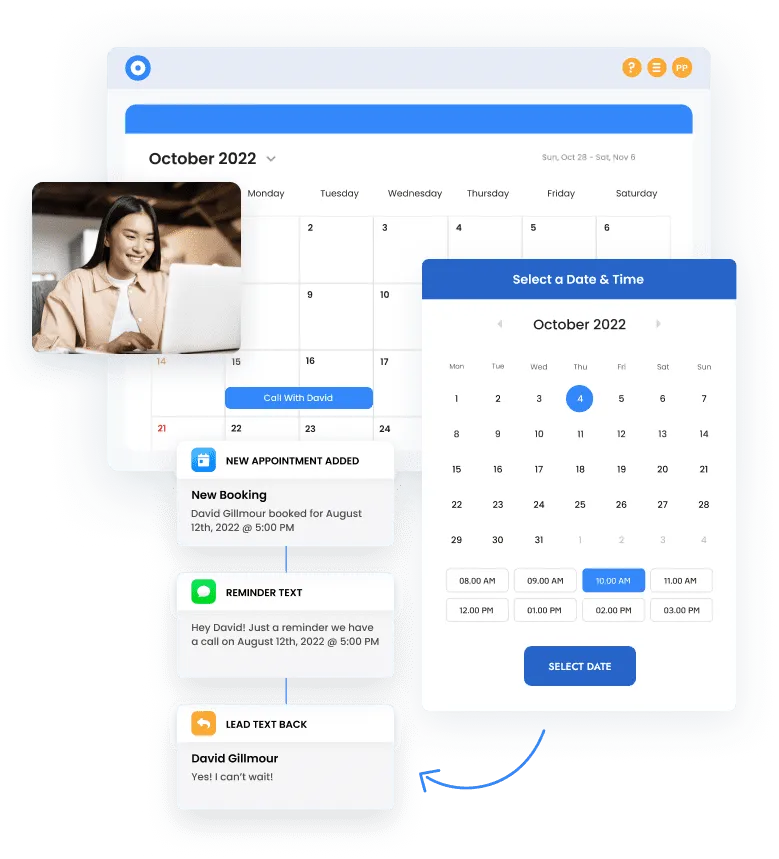

Scheduling Calendar - Our automated AI books pre-qualified prospects, for loan consultations, directly into your calendar. It sends follow-up reminders to reduce no-shows, and rescheduling workflows that re-capture prospects who miss their first appointment

Email/SMS Reminders - Personalized, multi-channel communication sequences, based on loan type, document requirements and meeting schedules

DIGITAL PRESENCE

Turn Your Website Into A Selling Machine

Smart Websites - Launch a mobile-optimized lending website, with AI chatbot integration, in hours instead of weeks using our intuitive drag-and-drop builder, and variety of templates, allowing you to project a professional presence without costly development delays

Funnel Builder - Create high-converting landing pages for specific loan products and marketing campaigns. Build complete application funnels that guide borrowers step-by-step through your qualification process, reducing abandonment and increasing completed submissions

Forms, Surveys & Quizzes - Implement intelligent application forms, surveys and quizzes that adapt based on borrower responses, provide education on loan products and qualify prospects based on pre-defined criteria

AI Powered Webchat Widget - Integrate our AI webchat widget that pre-qualifies website visitors 24x7, answering common lending questions and collecting application information even when your team is unavailable

INTELLIGENT DOCUMENT PROCESSING

Document Management as a Competitive Advantage

Online Digital Applications - Streamlined online applications that are mobile-optimized and can be completed in minutes

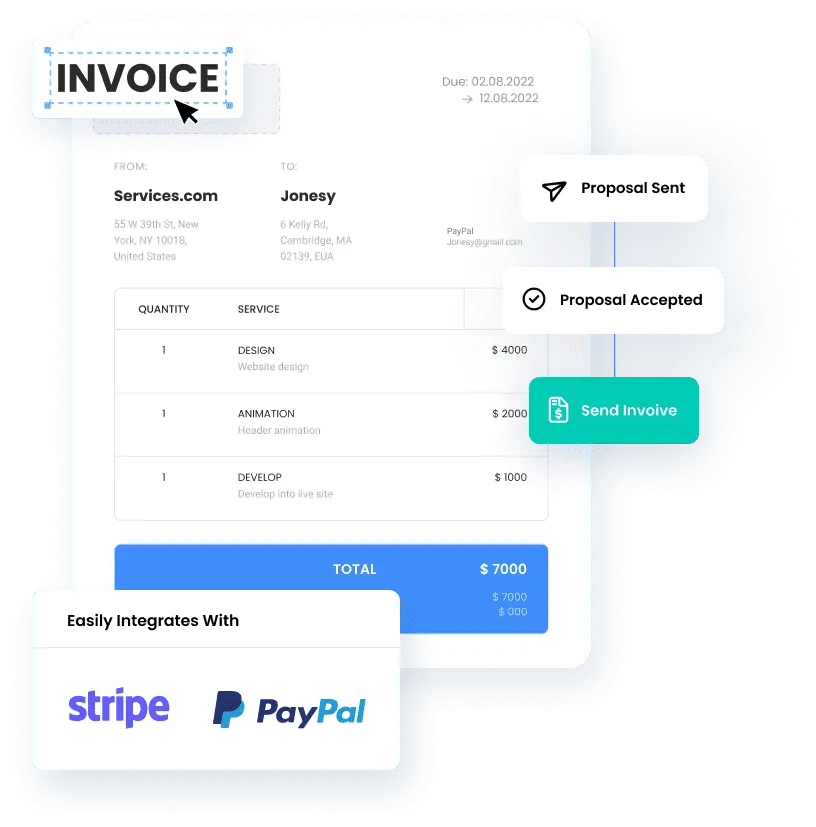

Documents & Contracts - Automated contract generation based on approved loan terms. Template library for different loan types and customization options that let you tailor contracts to specific deals (coming soon)

E-Signature - Automated, legally binding, electronic signature workflows that guide borrowers through document execution. Mobile-friendly signing experience that works on all devices. Audit trails that provide legal protection and regulatory compliance

Secure Document Uploads - Secure document portal that accepts all file types and sizes. Integration with popular cloud storage services for seamless document flow

Automated Invoicing - Professional invoices that reinforce your brand and build vendor/lender confidence. Automated late payment reminders that maintain cash flow without awkward calls

PROCESS AUTOMATION

Streamline Every Deal From Initial Lead to Closed Funding

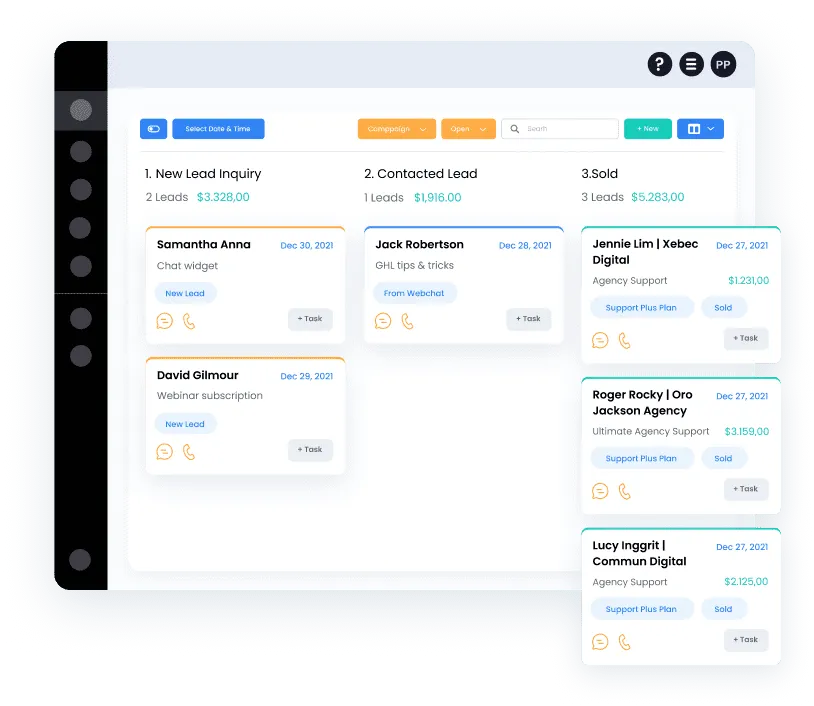

Opportunity Pipeline - Visual pipeline that shows exactly where every deal stands in your process. Automated stage progression based on completed tasks and milestones. Custom fields and Tags that track the specific data points important to your business

Automated Borrower Communication - Status updates that keep borrowers informed throughout the loan process. Proactive issue resolution that addresses problems and educational content that helps borrowers understand and complete required steps

Dashboard and Analytics - Real-time reporting that shows your most important lending KPIs. Conversion tracking that identifies where prospects drop out of your funnel. ROI analysis that proves which marketing channels generate the most profitable loans

CLOSE MORE DEALS

Turn Every Loan Into Multiple Future Opportunities

Request for Reviews - Automated review requests sent at the optimal moment after funding. Review response templates that handle both positive and negative feedback professionally

Reputation Management - Enhance your Google Business Profile, 5-star ratings, with monitoring tools that alert you immediately when new reviews are posted. AI-powered response automation that acknowledges positive reviews and addresses concerns quickly

Request for Referrals - Automated referral requests from satisfied borrowers, and referral campaigns to industry colleagues, with follow-up automation that nurtures potential referrals until they're ready to commit

See what our clients have to say

N2Open Digital has doubled my sales!

N2Open Digital has doubled my sales!

N2Open Digital has doubled my sales!

N2Open Digital has doubled my sales!

Share Your Value

Build Your Online Presence

Attract More Clients

Learn How Our All In One Marketing Automation System Can Transform Your Business

Solutions

Streamline Sales

Generate More Leads

Build Your Brand

Impress Existing Customers

AutomButtonate Tasks

Company